Schedule D Instructions 2024 1040

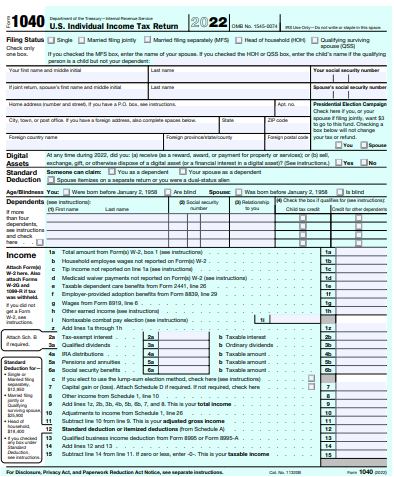

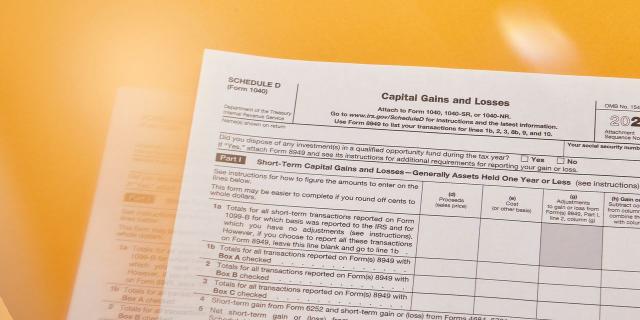

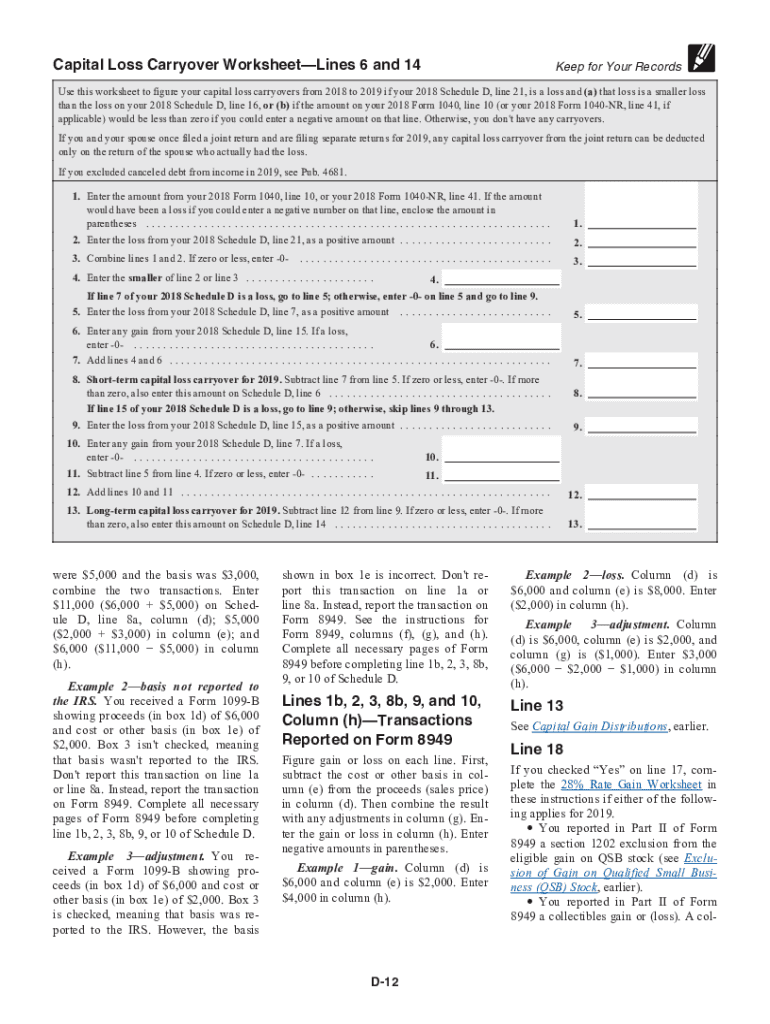

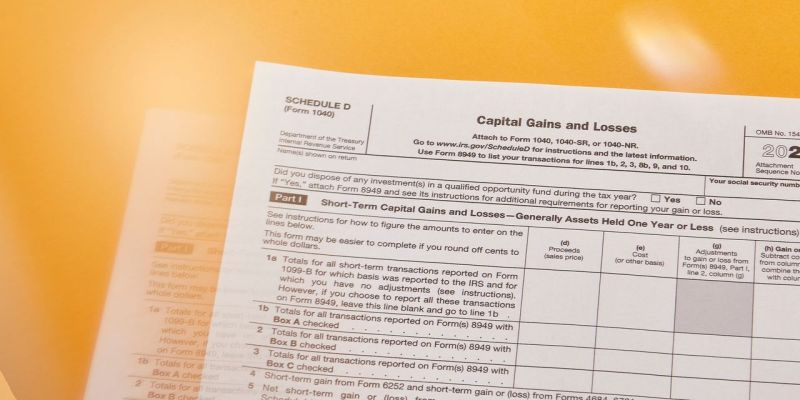

Schedule D Instructions 2024 1040 – the IRS writes in its Schedule D instructions. If your business sold a stock, bond or other investment asset, you will receive a 1099-B form with all of the information on the sale from each and . Form 8949 must be filled out before you can move forward on Schedule D. The instructions for Form 8949 Part I and Part II on Schedule D of Form 1040. Form 8949 provides directions at the .

Schedule D Instructions 2024 1040

Source : www.incometaxgujarat.orgWhat the 2024 Capital Gains Tax Brackets Mean for Your Investments

Source : finance.yahoo.comSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govPaul D. Diaz, EA, MBA on LinkedIn: Congress hasn’t made changes to

Source : www.linkedin.com1040 (2023) | Internal Revenue Service

Source : www.irs.govFiling taxes for your restricted stock, restricted stock units, or

Source : workplaceservices.fidelity.comWhat Is Schedule D: Capital Gains and Losses?

Source : www.investopedia.comForm 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions

Source : www.incometaxgujarat.orgCarla M. Morgan, CPA | Nacogdoches TX

Source : m.facebook.comSchedule D Instructions 2024 1040 Form 1040 for IRS 2024 ~ What is it? Schedule A B C D Instructions : The Internal Revenue Service (IRS) has recently released the updated Schedule 1 tax form and instructions for the years 2023 and 2024 on the standard Form 1040. It includes sections for . As previously reported, the IRS starts accepting and processing individual tax returns on Jan. 29, 2024 Dividends), Schedule C (Profit or Loss From Business), Schedule D (Capital Gains .

]]>

:max_bytes(150000):strip_icc()/2023ScheduleDForm1040-bce9771cbe94498ab34d6b9107e208de.png)